04 , May , 2022

In a major move, the RBI has increased the benchmark lending rate by 40 basis points to 4.40 per cent to contain inflation that has remained stubbornly above the target of 6 per cent for the last three months. This announcement comes after an unscheduled MPC meeting held on Wednesday. The move will certainly raise borrowing costs for corporate and individuals.

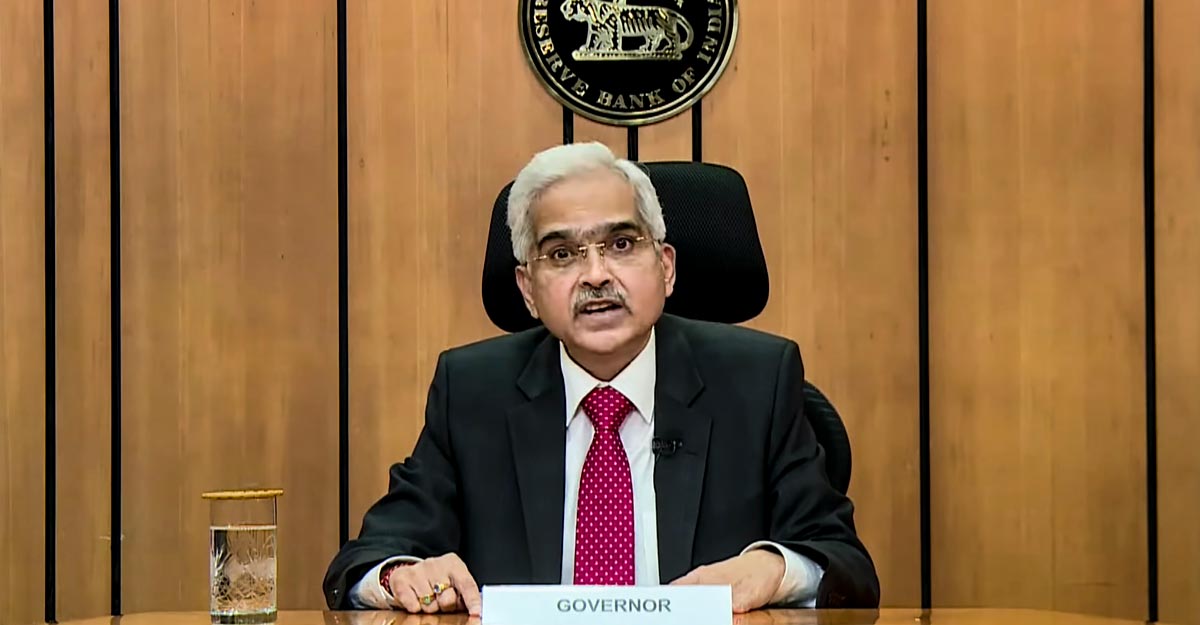

Moreover, RBI Governor Shaktikanta Das, also raised the amount of deposits banks are required to maintain a cash reserve by 50 bps to 4.5 per cent to suck out Rs 87,000 crore of liquidity from the banking system. Since August 2018, this is the first-rate hike and the first instance of the MPC making an unscheduled increase in the repo rate (the rate at which banks borrow from the RBI).

The Monetary Policy Committee unanimously voted for a rate hike while maintaining the accommodative stance. While the inflation has remained above the targeted 6 per cent since January, Das said the inflation print in April is also likely to be high.

The retail inflation print for March stood at 6.9 per cent.

The governor said the MPC decision reversed the May 2020 interest rate cut by an equal amount. It was on May 22, 2020 that the central bank had last revised its policy repo rate or the short-term lending rate in an off-policy cycle to perk up demand by cutting the interest rate to a historic low of 4 per cent.

This announcement comes days after the 595th meeting of the Central Board of Directors of the Reserve Bank of India. On Monday, the central board of the RBI approved the nomination of Rajiv Ranjan as a member of the MPC. Ranjan replaced Mridul Saggar, who retired on April 30.

Ranjan is the third internal member (ex-officio) of the MPC. The next monetary policy meeting is scheduled for June 6-8.

In the last MPC meeting, it was decided to stick to an accommodative stance “while focussing on withdrawal of accommodation to ensure that inflation remains within the target going forward while supporting growth”.

(WITH INPUTS TAKEN FROM PTI)