21 , May , 2020

What exactly the ‘Atamnirbhar’ package holds for real estate sector?

By Divya Roy Choudhury

Real estate sector came to a standstill due to the Covid-19 pandemic. The developers are dealing with a prolonged period of low to no demand which can continue to another few months. This future uncertainty is further intensified as the real estate developers are witnessing high constructional cost, shortage of labourers etc.

Giving the developers a ray of hope government announced 20 lakh crore relief package to revive the economy. For real estate, the package includes measures like a Rs. 30,000-crore liquidity support to lenders, temporary relief to builders from regulatory penalties in case of any COVID-19-caused project delay and an extended Credit-Linked Subsidy Scheme for the middle income group to push the affordable housing segment. The relief package has received a mixed response as some are expecting the measures to boost housing and construction and other few opined that more needs to be done as this will only give a temporary relief.

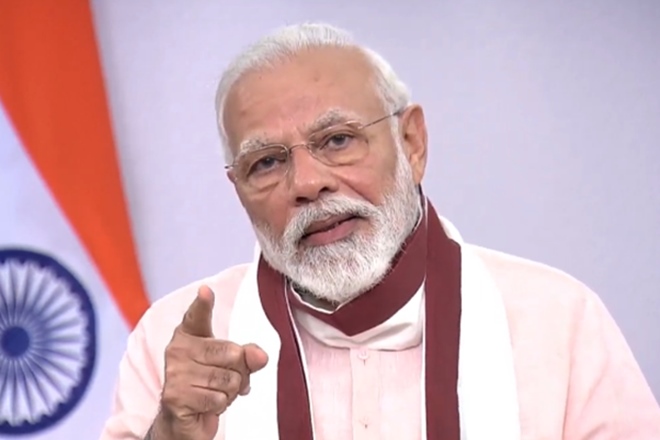

For unversed the 20 lakh crores relief package announced by PM Narendra Modi aimed boost the economy is one the biggest relief fund shelled out by any government around the world. It is approximately 10% of India’s GDP in 2019-20 and would rank behind Japan, the US, Sweden, Australia and Germany.

Let’s first understand what the package holds for real estate sector-

1. Treating delays as Act of God – To de-stress real estate developers, the Ministry of Housing and Urban Affairs will advise States/UTs and their Regulatory Authorities to treat COVID-19 as an act of God under RERA. And hence asked them to extend the completion date of projects expiring on or after March 25, 2020, by another six month.

“The sector has been requesting the government for measures that can help maintain the good image of real estate that has emerged especially after this government came with RERA. The latest 'Act of God' would have wiped out all the positive efforts made by the developers towards streamlining. In this backdrop, the announcements made by the FM will help the sector save its hard-earned image”, said Yash Miglani, MD Migsun Group.

2. Liquidity For Realty NBFC’s - The government announced a Rs. 30,000-crore liquidity scheme for non-banking financial companies, housing finance companies and microfinance institutions to ensure sufficient liquidity for realty companies, which rely heavily on borrowing.

Prateek Mittal, Executive Director, Sushma Group said, “We welcome the measures undertaken by the government to support the real estate sector amidst the ongoing crisis. With the infusion of Rs. 30,000 crore to the NBFCs, liquidity crunch in the housing finance will be eased off to an extent. Apart from that, post giving the green flag to resume the construction activities, the extension of registration and completion date suo moto by 6 months will certainly provide great relief to the developers, who have been struggling in coping up with the timelines due to covid19 lockdown.”

3. Rs. 3 Lakh-Crore Boost For Small Businesses – The relief package includes collateral-free or unsecured loans worth Rs. 3 lakh crore for small businesses. The measure will aid in reducing job losses and tweaked the definitions of micro, small and medium enterprises to extend the benefit to a larger number of companies.

Uddhav Poddar, MD, Bhumika Group said, "We welcome the announcements made by Hon’ble PM and FM, and hope for the speedy implementation of all of these as the economy is already in the ICU state. Real estate is one of the largest employment generators, employing a large part of migrant labour population of the country welcomes the reliefs pertaining to extension of project completion deadlines, but the main concern today is of liquidity and for that there needs to be a direct push to banks and NBFC’s to lend to this sector. Overall very positive but quick implementation would be the key".

4. Extension to affordable housing scheme - The CLSS scheme for affordable housing has been extended till March 2021, as a step to support the lower middle class sector that earns an annual income of Rs 6 lakh-18 lakh. Currently, there are 15.62 lakh under-construction units across seven top cities in the country, nearly 39 per cent of which are in the affordable segment, according to Anarock.

“Real estate sector has always been in a hustle of delivering projects within registered timelines, procuring timely approvals from authorities and departments. The lockdown bringing every sector to standstill added to the miseries of the property market. We are grateful for the government’s intervention with reduced repo rates, resuming of construction activities, the recent announcements of extended timelines for registered projects and an additional extension of 3 months for projects by RERA. They will be distressing the developers and providing assurance to the home-buyers for timely deliveries. A foresighted approach for issuing fresh ‘Project Registration Certificates’ automatically with revised timelines, reflects hope for a promising future” said, Vijay Verma, CEO, Sunworld Group

5. Adjournment of insolvency cases - The government also suspended filing of new bankruptcy cases for one year, and said debts related to COVID-19 will not be treated as default under the insolvency law temporarily..

“The recent announcements made by FM Nirmala Sitharaman under the Self- Reliant India Movement have eased the developments for the real estate sector in coming months. It has treated COVID-19 as an event of ‘Force Majeure’ under RERA, along with extension of registration and completion date suo-moto by 6 months for all registered projects expiring on or after 25th March, 2020 without any individual applications from the developers. The liberty of extending it by another 3 months is also given to regulatory authorities. We welcome the government’s measure for understanding our position in this difficult time and helping us maintain positive relations with our customers. Post- COVID scenario has been eased out for us, and we would be looking forward to complete our projects under this new timeline, with due support from RERA and Urban Ministry authorities”, said, Rajat Goel, JMD, MRG World.

What lies ahead?

As we all are dealing with the current economic crunch, the package will surely provide relief to at least small developers and builders. As India is a consumption driven economy, we hope that once the pandemic gets over the size of population and demand in sector will help the economy to bounce back.